Bitcoin (BTC) has been experiencing a surge in price, and this upward momentum enabled the leading cryptocurrency to surpass the psychological level of $60,000 briefly. BTC was up by 3.07% in the last 24 hours to hit $59,075 during intraday trading, according to CoinMarketCap.

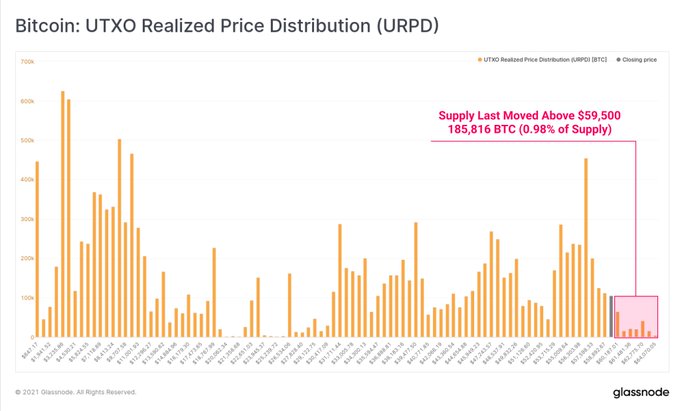

Nearly 100% of Bitcoin supply is back to profitability. On-chain metrics provider Glassnode explained:

“With Bitcoin attacking $60k once again, only 0.98% of the circulating supply was last spent at higher prices. Owners of this 185,816 BTC hodled throughout all the volatility, the ups, and the downs of the last 6 months. 99.02% of all BTC supply is now in profit.”

Bitcoin set a record high price of $64,800 in mid-April, but a looming correction drove the top cryptocurrency to lows of $30K a month later.

Why is the Bitcoin ETF approval by the SEC important?

According to Bloomberg, the Securities and Exchange Commission (SEC) gave positive indications that it could soon approve various Bitcoin futures ETFs.

This approval is essential because millions of Americans will be in a position to gain crypto exposure. Furthermore, the public will see Bitcoin as a legitimate asset class.

Bitcoin Exchange Traded Fund (ETF) is a type of security that tracks the overall price of Bitcoin. It enables investors to trade and purchase shares of it on traditional exchanges, circumventing crypto trading platforms.

By holding an ETF, investors can access many stocks in the same category, such as the banking industry, the tech industry, or the oil industry. ETFs offer diversity to investors’ portfolios and provide a mixture of investments such as stocks, commodities, and bonds.

Image source: Shutterstock